China is the 2nd largest market of beauty products after the United States in terms of revenue and consumption – growing at a rate of 13% annually (source: Statista 2021). According to Statista, the Chinese beauty and personal care market are expected to be worth more than $78 billion by 2025. Thanks to the growing urbanization and influences of digital media and social media, the beauty market is one of China’s fastest-growing and most promising business sectors for the foreseeable future.

Increasing Demand for Luxury Beauty Products

Chinese female consumers are very brand conscious. They love buying from “famous brands” as they believe higher reputation and prices equate to higher quality. The affluent Chinese consumers use luxury brands or expensive products as a way to show their social status. This explains why Chinese consumers are more likely to purchase skincare and makeup from luxury brands.

This trait also applies to the Chinese consumers in Canada. According to the Chinese Consumer’s Study by Vivintel, 1 in 3 Chinese consumers in Canada agree with the statement, “I buy luxury brands to feel different from the rest of society” – This is even more so the case with Chinese international students who indicate an even greater affinity towards luxury brands than the general Chinese population.

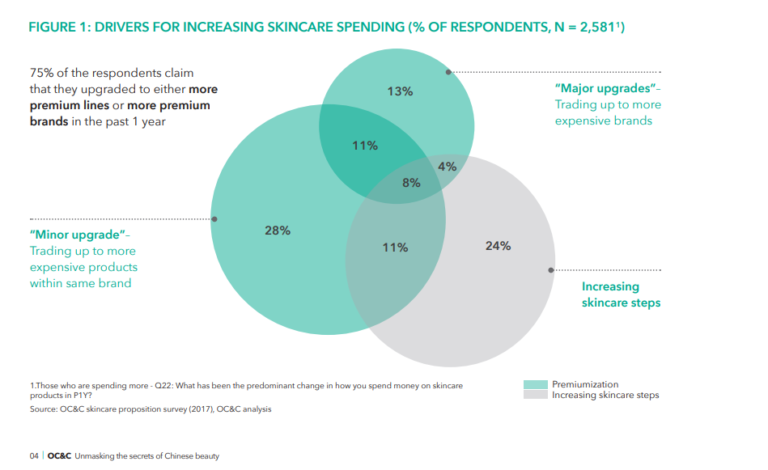

A survey by OG&C Strategy Consultants found that 58% of Chinese people claimed that they want to purchase a more expensive product. While 36% of Chinese consumers upgrade to more premium brands.

Foreign Brands First

For many Chinese ladies, foreign brands are considered more “premium “. Foreign brands play a very dominant role (over 86% retail market share) in the Chinese cosmetic market over domestic brands even though the latter might have lower price tags. Chinese trust more foreign cosmetics brands because they bring them quality and recognition. Not surprisingly, 4 out of 5 leading cosmetics market players in China are foreign brands such as L’Oréal Paris, Lancôme, YSL, and Estée Lauder.

Younger Generations Drives the Market

Chinese consumers born in the 80s and 90s are the leading force of beauty consumption. In 2020, women in China under the age of forty spent more than RMB 1,000 ($156) per capita on cosmetics, accounting for nearly 70% of the total market.

In the early post–COVID era, Chinese consumers continued to look for unique beauty products, particularly trend-seeking members of Generation Z and millennials, accounting for 330 million and 140 million consumers, respectively. Gen Z consumers have emerged as a source of market growth and drivers for innovative concepts; at the same time, millennials form the core of Tmall’s (the most used e-commerce platform in China) lifestyle and luxury beauty consumers. These young consumers are constantly on the hunt for new, exciting products and brands that can help them express their individuality.

This consumer group knows and buys products through Chinese digital channels, moreover, they tend not to trust products and brands that they do not know. So, to be successful in the Chinese beauty products consumer market, marketers should understand the value of brand building on Chinese digital channels.

Male Chinese Beauty Market is Also Booming

Female consumers still dominate the Chinese beauty market, but their male counterparts are rapidly playing catch-up. Male consumers, especially millennials, are spending increasing amounts on beauty products. Their beauty product needs have gone from a simple facial cleanser to a rigorous beauty regimen that includes lotions, toner, creams, face masks, and cosmetics. On Tmall, the total number of Chinese men who are buying beauty products is growing faster than that of women.

According to Euromonitor International, the Chinese men’s skincare market is already three times the size of that in the U.S. and more than twice the size of the South Korean market.

The growth of the Chinese male beauty industry has been partly driven by an increasing number of male KOLs who wear makeup, such as Austin Li Jiaqi. Known as the “Lipstick King,” Li tries on various lipsticks and discusses the color, texture, packaging, and quality during his hugely popular live streams. Last October, a 12-hour live stream to kick off Alibaba’s Singles Day Shopping Festival.

Today, independent young women in China demand more from men in terms of style, culture, and appearance, forcing most men to raise their beauty games, too.

How Brands Speak to the Chinese Audience

The Internet and social media have become the main source of information for Chinese beauty consumers. As a result, apps, social media groups, digital networks, and online communities have become the most popular source of beauty and skincare products for consumers. In terms of Chinese digital marketing, having a presence on a wide range of channels to increase the number of consumer touchpoints is generally the best strategy. More and more beauty brands have also learned that Chinese social media facilitates effective dialogue with target consumers.

Take Advantage of Important Cultural Festivals / Shopping Events

Brand: L’Oréal China

Campaign: International Women’s Day customized content on multiple social platforms

Strategy: Before this International Women’s Day (also marked as Queen’s Day in China), L’Oréal collaborated with a group of Chinese celebrities, including Gong Li and Daniel Wu, for its campaign, “I Say I’m Worth It.” Through a series of short films and podcasts, the stars shared their journeys and thoughts on female empowerment, encouraging women to face life’s challenges and to discover their values.

The campaign highlighted the brand’s thorough understanding of femininity in China, creating a strong resonance with the brand’s target customers. With different channels from social platforms to audio programs, the campaign reached and engaged communities interested in female-related topics of discussion.

Brand: Sephora Canada

Campaign: Programmatic Display Ad Campaign

Strategy: Sephora has utilized the programmatic ad campaign to target the Chinese beauty intenders through their favorite Chinese websites, mobile apps during this Lunar New Year to promote their feature products and special offers. The campaign helped them reach a large segment of the Chinese audience in Canada not accessible through general marketing tactics and open exchange.

There are different Chinese festivals over the year which provide the best opportunities for brands to speak to the different target audiences in the Chinese demographics. The next coming up will be 520, Valentine’s Day celebrated by the Chinese new generations on May 20. Click this blog about 520 to find out more about it or contact us for a complete calendar of the Chinese Cultural Festival / Shopping Events.

WeChat Marketing

WeChat is an essential touchpoint for brands looking to provide consumers with the first-hand brand and product information. Of China’s 1.4 billion people, 86% of them use WeChat! Chinese immigrants and international students in Canada retain their media usage habits and are still heavy users of WeChat. There are over 800,000 daily active WeChat users in Canada.

Brand: Shiseido Canada

Campaign: WeChat KOL Advertorials

Strategy:

- Also leverage the great timing of Lunar New Year, Shiseido used WeChat advertorials on popular KOL accounts to deliver detailed information, values, and benefits of the new Ultimune 3.0 Power Infusing Concentrate in the formats and tones appealing to the target audience.

- The brand has also launched a Year of the Tiger Special Edition of three featured products to celebrate Lunar New Year with the Chinese audience.

Little Red Book

With a predominantly young, female user base, Little Red Book (Xiaohongshu) is an experience-sharing platform where consumers can discuss and comment on each other’s reviews of products and brands.

Brand: Kérastase Canada

Campaign: Little Red Book sponsored posts

Strategy:

- User review style posts were published on selected popular KOL accounts to showcase the Kérastase Chronologiste Hair Serum, induce engagement, and by the interest of the Chinese beauty intenders.

- With the algorithm-driven content feed feature of Little Red Book, the post did not only reach followers of the selected KOLs but also precisely more users who have been browsing beauty or haircare-related content on the platform.

Interested in learning more? Connect with us today.