To better understand the Chinese consumer market, we should never neglect the economic power of the younger generations. Even though they have not stepped into the major income earning stage yet, usually with financial support from parents in Chinese families, they have already started to shape their own styles of living as a significant consumer segment.

Members of the Generation Z, also known as Gen Z, are defined as the demographic segment born between 1996 and 2005 which puts them in the 16 to 25 years-old age group in 2021. Unlike Millennials, the generation that precedes them, the Chinese Gen Z segment grows up in a time of economic prosperity. This generation is the product of the single-child policy. Because of this, Gen-Z kids grew up in households without competition of resources among siblings and were pampered by parents and grandparents. They also witnessed China’s massive economic growth and grew up in an environment full of opportunity. A different approach to parenting and a more carefree lifestyle gave them different values and beliefs from their predecessors, which allowed them to grow up as optimistic and self-confident youngsters.

Gen z’s are used to high standards of living, rapid improvements, and technology as a form of their communication, entertainment, and commerce in their daily lives. This generation reportedly buys 15 per cent of all luxury goods sold in China, compared with a worldwide average of 10 per cent.

To help consumer brands understand how this unique background sets China’s Gen Z apart from older generations at home and their peers in other markets globally, McKinsey & Company conducted a consumer survey on this group. Following is a summary of their findings.

Latest trends about Chinese Gen Z all marketers should know:

Trend 1: Chinese Gen Z are optimistic, impulsive, and tend to outspend their budget

- They are most likely to buy products spontaneously. This behavior is driven in part by robust confidence in future earnings: 78 percent of Chinese Gen Z respondents said they believe they will earn more, or much more, in the future.

Trend 2: Desire for ‘unique’ products and services

- Customized products and tailored services appeal to Chinese Gen Z customers. They will favour a brand offering a “unique product” especially if it is bought as a gift, which is a big part of the Chinese consumer culture.

Trend 3: They are loyal to brands

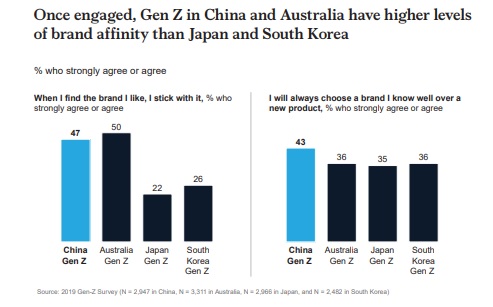

- Once engaged, China’s Gen Z are also more brand loyal: 47 percent agreed that they stick with brands they like, while 43 percent said they will always choose a brand they know over a new one. Successful brands increasingly leverage customer relationship management on social apps to keep customers engaged and retained.

Trend 4: Omnichannel shopping is on the rise

- Shopping and technology have always been intertwined in China, especially for tech-savvy Gen Z customers. They are more used to omnichannel shopping experiences compared to Gen Z in other countries. Taking apparel as an example, almost 40 percent of Gen Z consumers in China stated they would browse in-store but shop online while only about 15-30 percent of Gen Z in other countries stated they would do so.

Trend 5: They prefer individual merchants on e-commerce platforms

- The preference is based on the greater transparency and more quality assurance on these platforms. Gen Z consumers in China embrace online e-commerce sites that allow peer to-peer transactions such as Taobao and second-hand marketplace Xianyu to a greater extent than their elders.

Trend 6: Their buying decisions are most influenced by online version of word-of-mouth, not the traditional way.

- Online reviews, for example product experience write ups on Taobao, Tmall, or RED, as well as the opinions of friends and family on social media, remain powerful sources of influence across the generations in China. Gen Z also look for other sources (like bloggers, Key Opinion Leaders (KOLs), brands’ official social media accounts) for product recommendations.

Gen Z Chinese Newcomers in North America

The total Chinese population in Canada & the U.S. has surpassed 6.7 million according to the census data of the two countries in 2016. Among which over 15% falls into Generation Z. Like the more mature Chinese newcomers, Gen Z Chinese newcomers usually retain their consumer values and media usage habits from China as well. They are even more digital indulged. So, they will still visit their favorite Chinese websites, mobile apps, and video streaming platforms. To stay within the social circle with their friends and families, they stick with WeChat and Weibo instead of switching to Facebook then they live in North America.

Gen Z Chinese represent a segment with significantly stronger spending power then their western peers. For brands to win the hearts of this impactful segment of the Chinese consumer market, they should include the following tactics in the marketing initiatives:

- Reach them through their favorite Chinese digital platforms.

- Establish strong brand awareness, also deliver a unique proposition that appeals to this target segment, and support that with personalized messaging and services in order to build and retain consumer loyalty.

- Establish strong presence on their most widely used social media (e.g., WeChat & Weibo) to deliver brand values and product details. Lots can be done to engage the Gen Z consumers through collaborations with right KOL’s or popular publishing accounts or setting up of the brand’s official account.

Don’t forget about the International Students – the under-reported population of Gen Z

There is also a large group of Chinese international students in North America, of which the numbers are not included in the official Census data, thus has always been under-reported. There were 372,532 and 140,000 Chinese International Students in the United States and Canada respectively before Covid-19 hit.

With the reopening of both China and North America moving with positive progress and that the Canadian and US government have rolled out plans that ease visa rules for encouraging international students, we expect there will be a slight recovery of Chinese International students entering or re-entering North America as soon as this September and then a more significant influx in early 2022. After all, America and Canada are both among the top choices of study-aboard destinations for people in China.

The Chinese International Students, also mostly Generation Z, behaves like the Chinese newcomers and carries same needs when adapting to their new lives in North America, contributes significant spending power to the already large Chinese consumer market in the United States and Canada.

Interested in learning more? Connect with us today.